Introduction: A New Horizon for Finance in the Caribbean

For decades, the financial advisory landscape in the Caribbean has been built on a bedrock of personal relationships and trust. From Port of Spain to Kingston, the handshake and the face-to-face meeting have been the gold standard. But a new, powerful force is arriving on our shores, one that promises unprecedented efficiency and intelligence: Artificial Intelligence.

“The airwaves are buzzing with talk of AI bots and automated advisors. For many in the insurance industry, this raises a crucial question: is it AI versus the human advisor? Is this the future?

The answer, as Microsoft’s CEO Satya Nadella aptly puts it, is that the future ‘is not about humans versus machines, but humans with machines.’

As a professional who has spent years in both the financial services industry and the world of technology, I believe the answer is clear. The future is not AI versus the human advisor. The future—the successful future—is a powerful synergy of both. For those of us in the Caribbean, the challenge and the opportunity lie in how we weave these two worlds together.

The Unique Caribbean Challenge: High-Tech Meets High-Touch

Implementing AI in our region isn’t a simple copy-paste from Silicon Valley. We face a unique set of challenges and opportunities:

The Challenge of Trust: Our financial culture is deeply personal. Clients want to know who they are dealing with. They want to look their advisor in the eye. A faceless algorithm, no matter how smart, will struggle to earn the deep-seated trust that is the currency of our industry.

The Data Gap: Advanced AI thrives on massive, clean datasets. While improving, our regional data infrastructure can be fragmented, making it harder for AI to perform at its peak without careful implementation.

The Opportunity for Inclusion: At the same time, AI presents a massive opportunity to bring sophisticated financial tools and education to a wider audience, offering a level of service and analysis that was once reserved for only the wealthiest clients.

Synergizing AI and the Advisor: A Blueprint for the Future

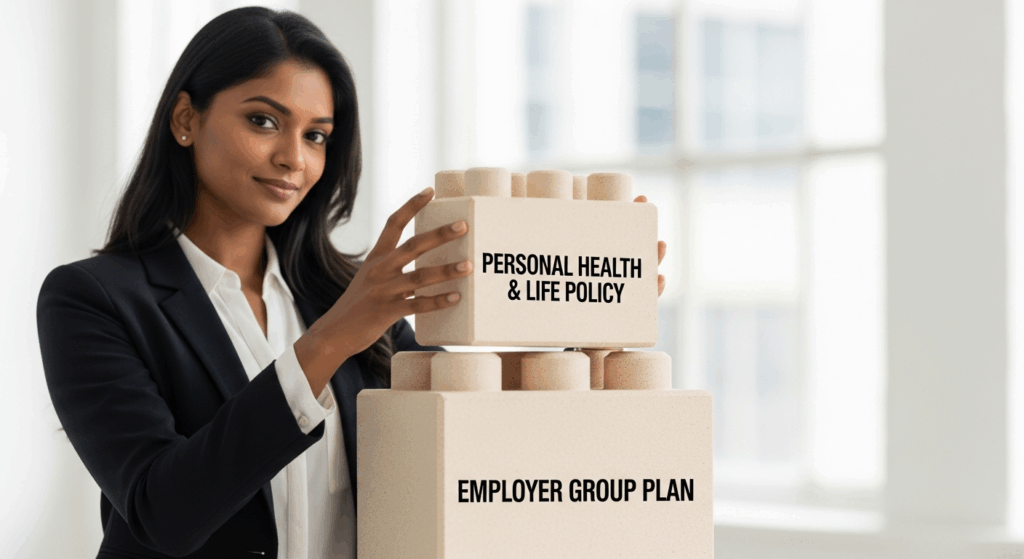

The smartest professionals won’t be replaced by AI; they will be the ones who leverage AI to become exponentially better at their jobs. Here’s how we can synergize these forces from the advisor’s point of view:

AI as the “Super-Analyst”: Handling the Data

An AI can analyze a client’s financial data, market trends, and complex policy documents in seconds. It can identify potential risks, find optimization opportunities, and run thousands of retirement scenarios. This frees the human advisor from hours of number-crunching.

The Human Advisor as the “Chief Strategist”: Providing the Wisdom

The AI provides the “what” (the data). The human advisor provides the “so what” (the wisdom). An AI can tell you the statistical probability of an event, but a human advisor who understands your family, your fear of risk, and your dreams for your children can help you decide what to do about it.

AI as the “Efficiency Engine”: Automating the Grunt Work

Think of tasks like scheduling meetings, sending follow-up reminders, and even filling out initial application forms based on conversation transcripts. AI tools can handle these administrative burdens, freeing up the advisor to spend more time on what truly matters: high-value, strategic conversations with clients.

The Impact of AI Tools on Service Delivery in Insurance

The change is already happening. Look at how specific AI tools are poised to revolutionize our industry’s service delivery:

AI Chatbots (like Tidio, which we use at TrueHaven): They provide 24/7 front-line support, answer common questions instantly, and qualify leads, ensuring that when a client speaks to a human, it’s for a meaningful, high-level conversation.

AI Voice & Video Avatars (like HeyGen, ElevenLabs): These tools allow for the creation of scalable, personalized educational content. An advisor can create a library of short, engaging videos explaining complex topics like annuities or “Special Perils,” reaching thousands of clients with a consistent, clear message.

AI Automation Platforms (like Lindy.ai, Zapier): These are the “digital nervous system” of the future agency. They can connect a client inquiry from your website to your calendar, update your client records, and draft a follow-up email, all in the background.

Jagdish’s Insight: The “Prosthetic Brain”

“I don’t view AI as an artificial replacement for my brain. I view it as a powerful ‘prosthetic brain.’ It outsources the tasks of mass data recall and repetitive processes, allowing my human brain to focus on empathy, strategic thinking, and building genuine relationships – things that can never be automated.”

The Irreplaceable Human Value: Trust, Empathy, and the Relationship

And this brings us to the most important point of all.

An AI can analyze a policy, but it cannot sit with a family after a loss and provide a comforting presence. While it can calculate a retirement projection, it cannot understand the deep emotional significance of a parent wanting to leave a legacy for their children. And though it can process a claim, it cannot offer the human reassurance that “we will get through this together.

Trust is not built by algorithms; it is built through consistent, empathetic, human interaction. In the Caribbean, this is the core of our business. The future of financial advisory is not a robot closing a sale. It is a human advisor, super-powered by AI, who can provide a level of service, insight, and personal care that was never before possible.

Conclusion: The Choice Ahead

The technological tsunami is here. We in the Caribbean financial and insurance industry have a choice. We can be afraid of the wave and risk being swept away, or we can learn to surf. By embracing AI as a tool to enhance our uniquely human strengths—our empathy, our wisdom, and our ability to build deep, lasting relationships—we can not only survive but thrive, delivering unprecedented value to our clients and securing our own place in the future of finance.

At TrueHaven Advisory, we are committed to being at the forefront of this evolution. We believe in combining the best of cutting-edge technology with the timeless value of a trusted human partnership. If you’re ready to see what the future of financial advice looks like, let’s start a conversation. Contact Us Today